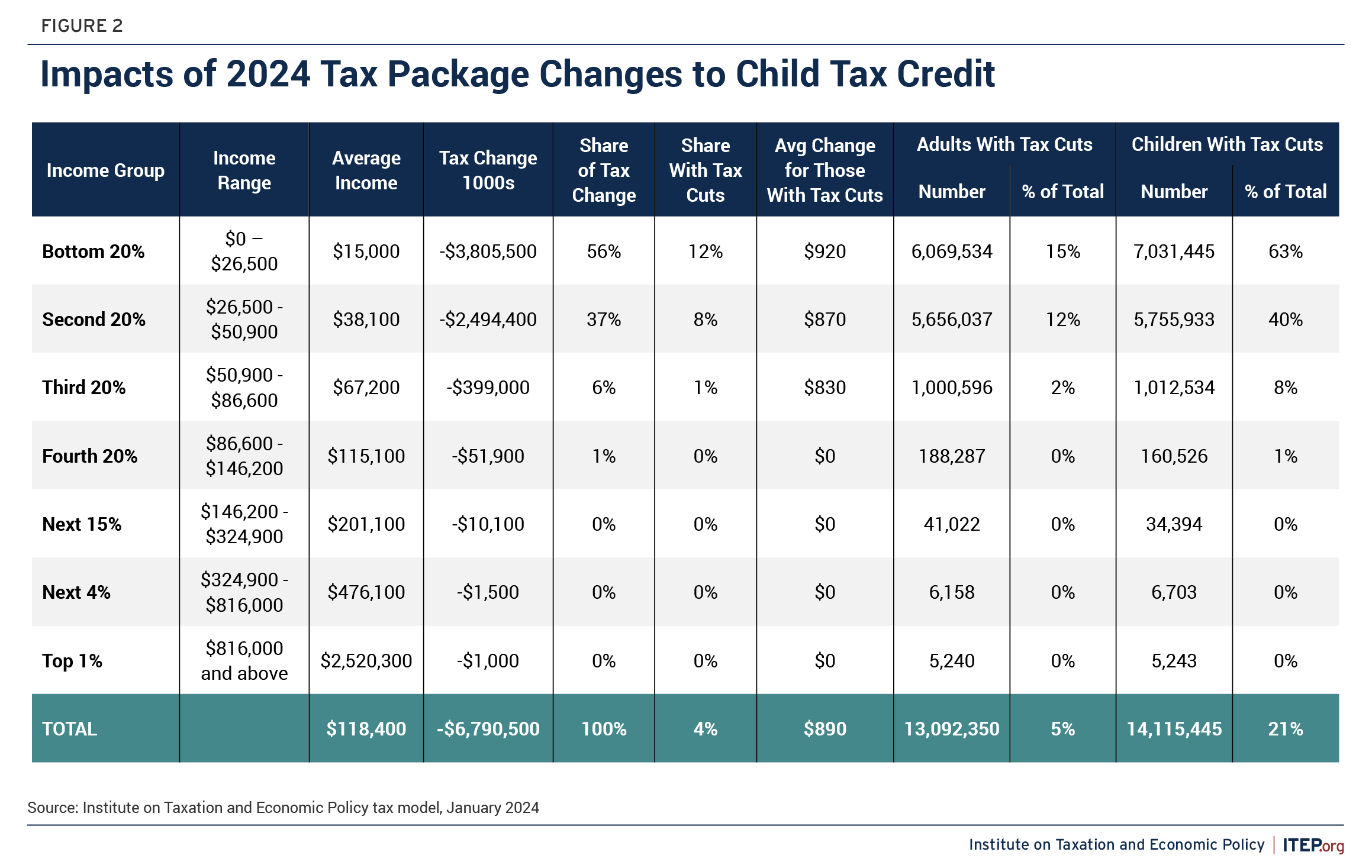

Retroactive Tax Credits 2024 Calculator – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . Here’s how a proposed change in the rules for the child tax credit impact tax refunds and the upcoming tax season. .

Retroactive Tax Credits 2024 Calculator

Source : www.shrm.org

Town: Avoid penalties, pay taxes by Feb. 12 Bethpage Newsgram

Source : www.bethpagenewsgram.com

Report: Wealthy Michiganders pay lower taxes than everyone else

Source : michiganadvance.com

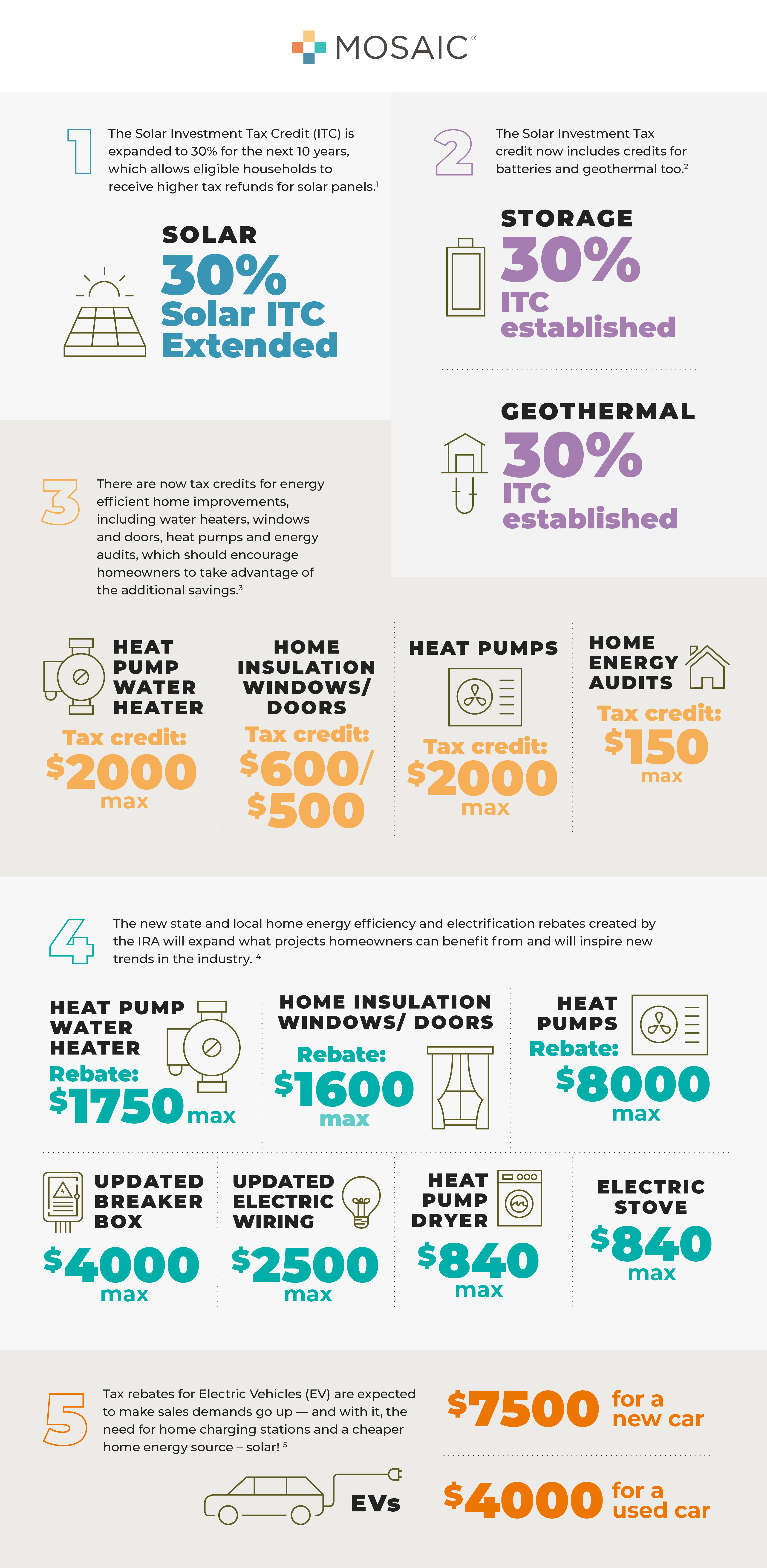

Product Trends: Opportunity of a Lifetime QUALIFIED REMODELER

Source : www.qualifiedremodeler.com

5 Ways The IRA Will Benefit Homeowners (and Contractors)

Source : joinmosaic.com

Town: Avoid penalties, pay taxes by Feb. 12 Mid Island Times

Source : www.midislandtimes.com

Proposed Tax Deal Would Help Millions of Kids with Child Tax

Source : itep.org

3 Large Cap Stocks 5 Star Analyst Picks for 2024 TipRanks.com

Source : www.tipranks.com

Employee Retention Tax Credit Retroactively Terminated: What To Do

Source : anderscpa.com

Federal Solar Tax Credit 2024: What It Is & How Does It Work

Source : www.freshbooks.com

Retroactive Tax Credits 2024 Calculator Retroactive Filing for Employee Retention Tax Credit Is Ongoing : Child tax credits are likely to be expanded thanks to a $78 billion tax agreement between the Democrat-led Senate Finance Committee and the Republican-helmed House Ways and Means Committee. . Opinions expressed by Forbes Contributors are their own. I write about how to maximize your automotive investment and more. As part of the highly-touted Inflation Reduction Act, Congress extended .